| 8 mins read

In the 1990s, well over a quarter of Britain's pensioners lived in poverty. By the mid-2010s that had fallen to fewer than one in six, although that has ticked up in recent years. At the same time, the number of relatively well-off pensioners has risen sharply.

Meanwhile, spending on pensions and other benefits for the retired has risen from just under 5 per cent of GDP to about 5.5 per cent, at the same time as benefit spending on those of working age has fallen by a similar amount. More broadly, a growing proportion of state spending benefits the elderly.

This growing imbalance has in turn focussed attention on the ‘triple lock’ which currently governs the uprating of the basic state pension. Introduced in 2011, the impact of this has been that the pension has risen by a little more than 10 per cent compared to either prices or earnings.

This year, with average earnings currently running ahead of prices, it is expected that the triple lock will again result in an above inflation rise, at a net fiscal ‘cost’ of up to £2 billion. This has led to renewed calls for the triple lock to be ended or scaled back in some form.So far, neither the government nor the opposition has been prepared either to endorse it wholeheartedly or explicitly to commit to reform.

Criticism of the triple lock, and more broadly of the substantial increases in the level of the basic pension over recent years, has several dimensions: that such increases are ‘poorly targeted’; that increasing pension at least as fast as earnings or prices prioritises pensioners at the expense of working age benefit claimants; that such increases are fiscally unsustainable; and that the triple lock embeds a ratchet effect.

While there is a kernel of truth in all these criticisms, but they largely miss the point.

Background to the ‘Triple Lock’

Thatcher’s legacy for pensions was part of the ‘safety-net’ state. Her government cancelled the earnings link and this resulted in a fall in the relative value of the pension by more than a third, bolstered by the maturing of occupational pension schemes.

This inheritance posed a dilemma for New Labour—a dilemma Gordon Brown attempted to resolve through ‘progressive universalism’. But the erosion of the basic state pension continued. And, most worryingly, far from occupational and private provision of pensions becoming the norm for the vast majority of the workforce, as Thatcher had hoped, exactly the opposite transpired. Tighter regulation, lower long-term interest rates and higher taxes led to a progressive collapse in the provision of defined benefit pension schemes in the private sector, only partially, if at all, replaced by much less generous defined contribution schemes.

The Pensions Commission, established in 2003, was a response to this collapse. So, when they recommended restoring the earnings link, in combination with the new system of ‘auto-enrolment’ into workplace pensions, this was not primarily about addressing the needs of the poorest pensioners. Rather, it was meant to rebalance the system. First, from a state system that built in an ever-growing reliance on means-tested benefits, back towards one where the universal basic state pension was the key pillar for most pensioners; and second, from a private pension system that provided well for a shrinking minority of public sector (and some very well-paid private sector ones) to one that provided a meaningful supplement to the basic pension.

If the shift from the basic pension to means-tested benefits had been allowed to continue, the introduction of auto-enrolment, which is targeted at lower- and middle-income earners, would have been a far more difficult sell.

Two decades on, it is difficult to see the results as anything other than a remarkable success. So, does this mean that we can say ‘job done’ and abandon the triple lock? In short, no.

Defending the ‘Triple Lock’

It remains the case that both the level of the basic state pension and state spending on pensions and related benefits is relatively low in the UK. That in itself is not problematic if, and only if, we can continue to build up private provision for the majority of the population. The Pensions Commission argued that achieving this required a basic pension at a reasonable level, relative to earnings, and its analysis remains valid. There's no right answer as to precisely what level that should be, but it's close to impossible to believe that it's below 25 per cent. And, despite the success of auto-enrolment, the need for the basic pension as a floor for retirement incomes is likely to increase.

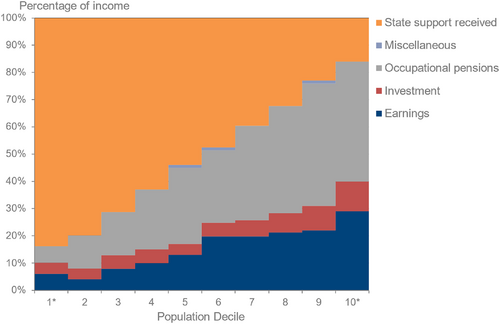

The key objections to raising pensions do not, by and large, stand up to analysis. It's true that a rise in the basic pension benefits millionaires. But state pension spending makes up a substantially greater fraction of the incomes of poor and middle-income pensioners than those who are better off, as shown in Figure 1.

Figure 1 Income sources as a percentage of gross income by decile, households containing pensioners and no children (‘Households below average income statistics’, Department for Work and Pensions, March 2023.

And further targeting spending has its own drawbacks. It is an iron law of the tax and benefit system that more targeting requires more means-testing, and that in turn impacts on incentives; in this case, to savings incentives for those on lower and middle incomes. We could avoid this issue by removing state pensions just from those on very high incomes, but that would be hugely difficult and could be achieved more easily via taxes.

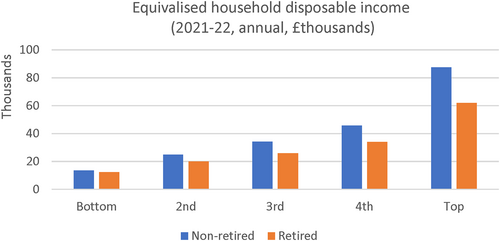

Meanwhile, substantial increases in poverty for working-age people on low incomes is overwhelmingly an issue of intra, not intergenerational inequality, as Figure 2 demonstrates – based on structural inequalities like gender and ethnicity.

Figure 2 Equivalised household disposable income, 2021–22 (‘Effects of taxes and benefits’, ONS, 2023.) Source: ONS, ‘Effects of tax and benefits on household income’, author's calculations

Similarly, complaints about ‘millionaire’ pensioners who are sitting on large capital gains as a result of the impact of rising house prices are not misplaced, but are a huge conceptual misunderstanding. The issue is the perpetuation of inequality across generations. Scaling back pension increases cannot address this issue; reforms to the tax system and housing policy are required.

There's a clear case for returning to a simple earnings link. In the meantime, the triple lock isn't perfect; but, alongside other policies, it has boosted pensioner incomes and helped make the broader UK pension system more sustainable.